Record-Breaking Performance in November

In November this year, Chery Group posted outstanding results across key business segments. Total vehicle sales reached 272,500 units, while export volumes hit 136,700 units, representing a 30.3% year-on-year increase. Notably, Chery has now maintained monthly exports above 100,000 units for seven consecutive months, firmly securing its position as China’s top automotive exporter.

In the new energy vehicle (NEV) segment, Chery sold 116,800 units in November, ranking third in the industry. This marked a 50% year-on-year increase, setting a new historical high and achieving a four-month consecutive growth streak.

Capital Market Recognition Strengthens Confidence

Chery’s operational performance has also attracted strong attention from capital markets. Zhongtai Securities recently initiated coverage on Chery Automobile (9973.HK) with a “Buy” rating, citing the company’s early-mover advantage in exports and its technological synergies across powertrains and platforms.

China International Capital Corporation (CICC) assigned Chery an “Outperform Industry” rating, setting a target price of HK$42 and forecasting a 22% compound annual growth rate between 2024 and 2026. These endorsements underscore growing institutional confidence in Chery’s long-term strategy.

Standing Out Amid Industry-Wide Pressure

As global automotive markets face tightening competition, pricing pressure, and uneven EV adoption, Chery has managed to achieve breakthroughs in both sales volume and profitability. Through sustained investment in core technologies and a well-executed global strategy, Chery has reinforced its position among China’s top-tier automakers.

Its performance over the first 11 months reflects broad-based growth rather than reliance on a single segment, combining steady overall expansion with localized surges in new energy and exports.

Three Core Drivers Behind Chery’s Market Competitiveness

1. New Energy Vehicles: The Primary Growth Engine

Chery’s NEV business has become its strongest growth driver. In November alone, NEV sales reached 116,800 units, up 50.1% year-on-year, marking a record high. Cumulative NEV sales for the first 11 months totaled 814,600 units, a 69.4% increase, surpassing the 800,000-unit milestone for the first time.

This growth is fueled by precise product positioning. New launches such as the Exeed ET5, Arrizo A9L Glory AWD, and 2026 Jetour Traveler C-DM were introduced in quick succession, covering both mainstream price segments and premium niches. At the same time, models like the fifth-generation Tiggo 8, under Chery’s “New Fuel” strategy, contributed to a dual-track approach combining electrification and high-efficiency combustion technologies.

2. Overseas Markets: Sustained Export Leadership

As China’s leading vehicle exporter, Chery continues to outperform peers globally. In November, exports reached 136,700 units, and cumulative exports for the first 11 months totaled 1.1995 million units, up 14.7% year-on-year. On average, a Chery-built vehicle is shipped overseas every 25 seconds.

Chery has made particularly strong progress in Europe, one of the most regulated automotive markets worldwide. From January to October, European sales reached 171,147 units, surging 2.4 times year-on-year. Instead of relying on a single brand, Chery entered markets such as Spain, Italy, the UK, and Hungary with a multi-brand portfolio including OMODA, JAECOO, and CHERY.

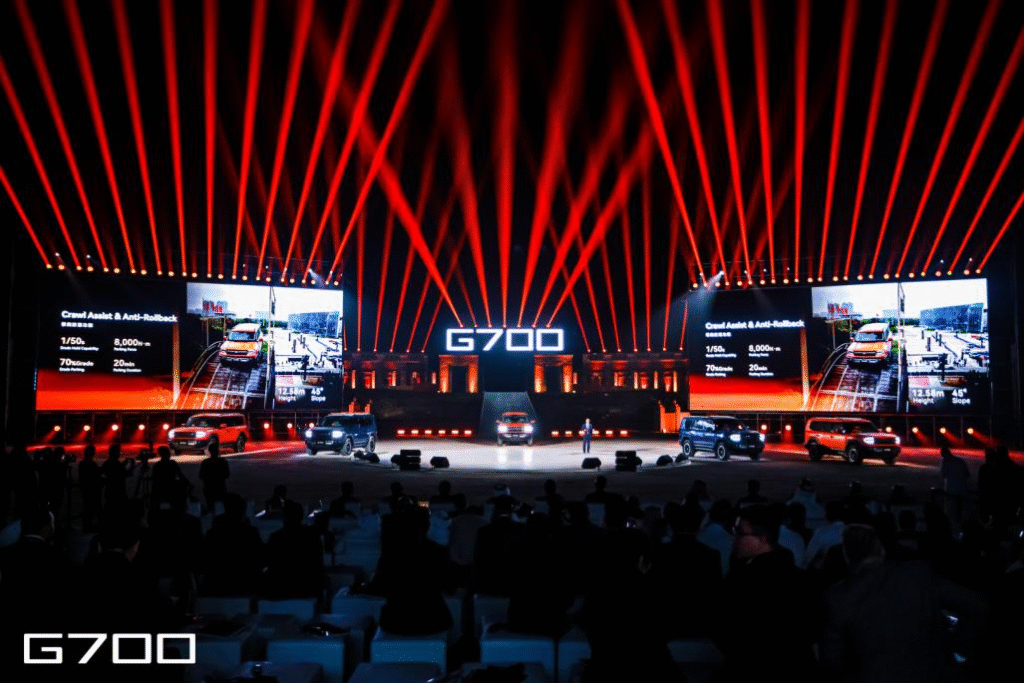

In the UK alone, Chery achieved a 2% market share within nine months, becoming the fastest automotive brand to reach this level. Expansion is also accelerating in France and Germany, while in the Middle East, the Omoda G700 luxury plug-in hybrid off-road model debuted in Dubai, targeting high-end consumers.

3. Multi-Brand Strategy: Full Market Coverage

Chery’s five-brand passenger vehicle matrix is now showing clear momentum. In November:

- Chery brand sold 165,500 units, with cumulative sales of 1.54 million units

- Jetour delivered 55,000 units, driven by its “Travel+” positioning

- Exeed, iCAR, and Luxeed each surpassed 10,000 units monthly

Luxeed, developed in partnership with Huawei, has entered the high-end intelligent vehicle segment. Exeed focuses on premium smart EVs, while iCAR targets younger, tech-oriented buyers. Together, these brands form a clearly segmented portfolio covering everything from entry-level commuting to luxury and off-road use cases.

Conclusion: Chery’s Global Strategy Is Delivering Results

Chery’s exceptional November performance highlights the effectiveness of its long-term strategy built on new energy transformation, export leadership, and multi-brand development. At a time when many automakers are struggling with slowing demand, Chery’s ability to grow across regions and powertrain types positions it as one of the most resilient players in the global automotive industry.

As Chery continues to expand its presence in Europe, the Middle East, and other international markets, its rising competitiveness suggests it may soon become an increasingly relevant option not only for emerging markets, but also for global consumers — including those in the United States — seeking technologically advanced and cost-effective alternatives in the evolving automotive landscape.

This really answered my problem, thanks!